What Impact Would A Dramatic Increase In The World Price Of Oil Have On The National Economy

A look into the event of higher oil prices on economies, firms and consumers.

Readers Question: With oil prices rising towards $100, what are the economic furnishings of rising oil prices?

- In the short term, higher oil prices volition pb to college costs of production, increased inflation, and decreased living standards for consumers of oil

- In the long-term, higher oil prices tin stimulate investment in oil (and alternative energy sources) and likewise encourage consumers to seek alternatives (e.thousand. electrical cars.)

Primary effects of ascension oil prices

Higher revenue for oil producers

Need for oil is inelastic, therefore the ascent in price is good news for producers because they will see an increment in their revenue. Oil importers, however, will experience increased costs of purchasing oil. Because oil is the largest traded article, the effects are quite meaning. A ascent oil price can even shift economical/political power from oil importers to oil exporters.

Current Account

College oil prices volition lead to an improvement in the current account position of oil exporters similar OPEC countries. It volition lead to a deterioration in the current business relationship position of oil importers (e.g. Federal republic of germany, Red china). Oil exporters will meet an increment in foreign currency reserves which they could utilise to purchase foreign assets. e.g. Arabic countries, such as Kingdom of saudi arabia are an of import purchasers of United states securities.

Inflation

Higher oil prices will cause an increment in the cost of transport, therefore virtually goods will increase in prices.

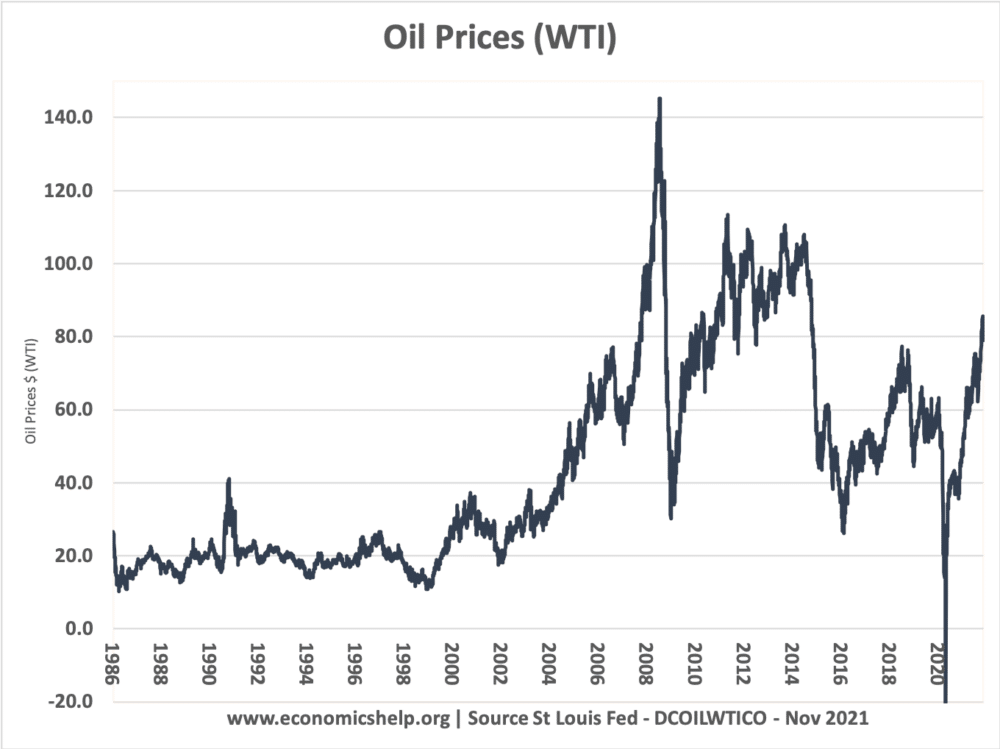

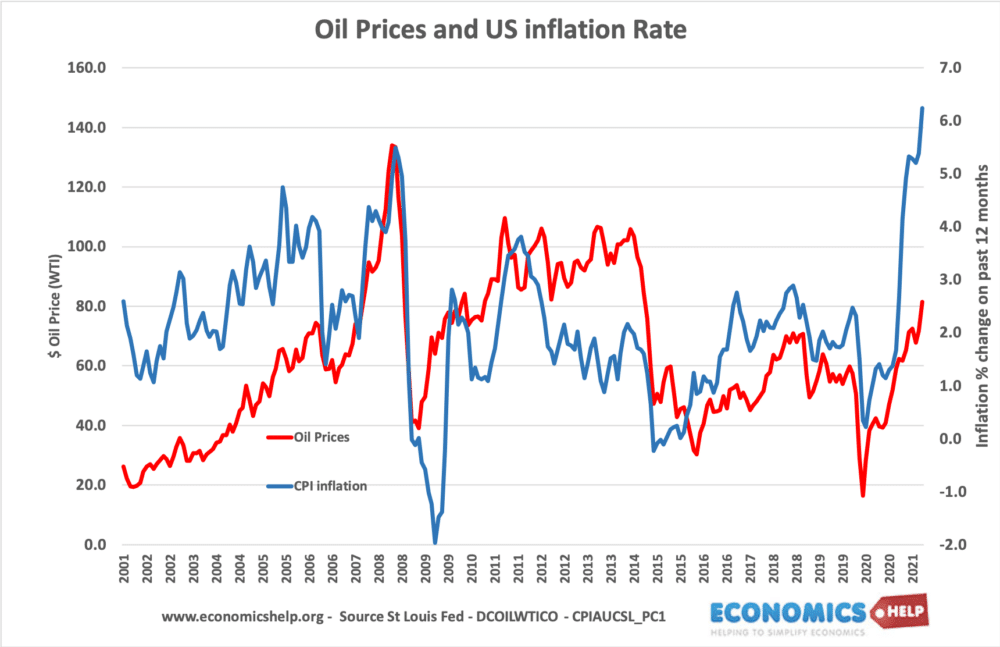

Inflation in 2008 and 2022 were both partly due to higher oil prices.

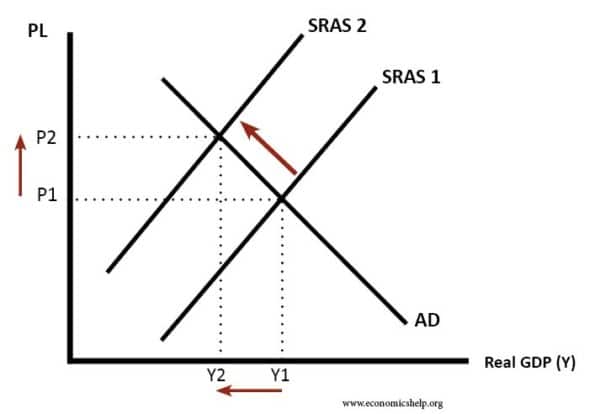

Oil causes a shift in SRAS

A marked ascent in oil prices will contribute to a higher inflation level. This is considering transport costs will ascent leading to higher prices for many goods. This will be cost-push inflation which is quite different to inflation caused by rising aggregate demand/excess growth.

Consumers will come across a fall in discretionary income. They face higher transport costs, but don't have the compensation of rising incomes. Higher oil prices tin atomic number 82 to slower economic growth – particularly a trouble if consumer spending is weak.

A key issue is whether inflation from higher oil prices will evidence temporary or permanent. Often, higher oil prices only cause temporary inflation – eastward.k. in 2008, inflation rose to 5%, but then fell back towards 0% shortly after.

Monetary Policy

Price-push aggrandizement caused by rising oil prices presents a dilemma to policymakers. Higher inflation commonly requires higher interest rates to keep inflation on target. But, reducing inflation may non exist appropriate because output could exist well below full employment. Arguably, in early 2008, policymakers gave too much importance to the cost-push inflation and too footling weight to the impending economic downturn.

Long-Term effects of higher oil prices

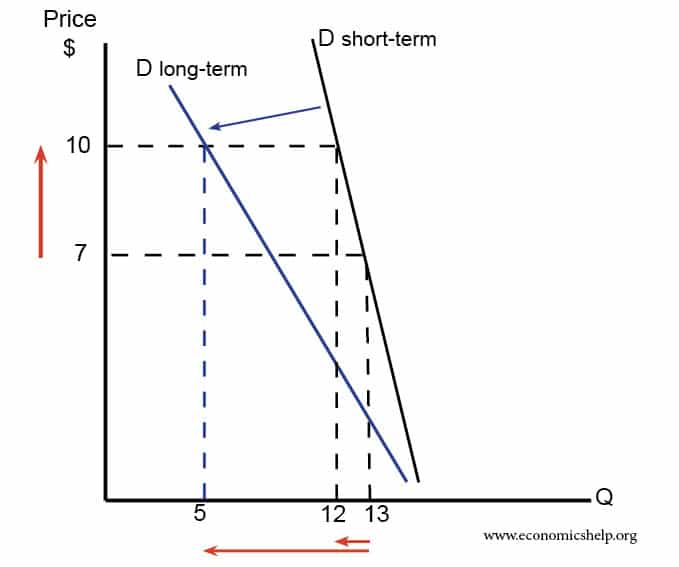

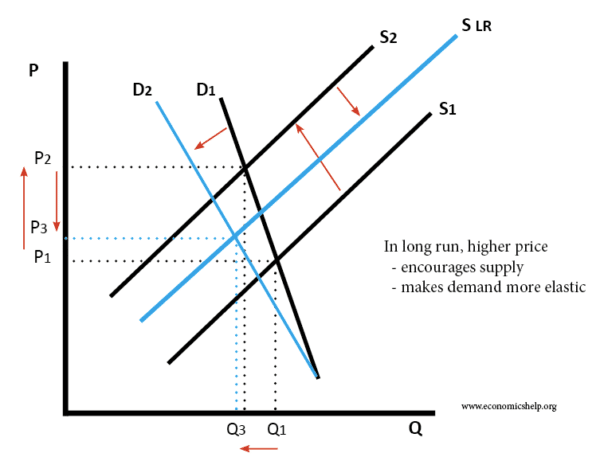

In the brusk term, demand for oil is inelastic. This means a ascension in cost just causes a small-scale fall in demand. Demand is price inelastic considering consumers need oil-based products, e.g. their auto just runs on petrol.

Yet, in the long term, higher oil prices will encourage consumers to diversify consumption (e.chiliad. buy hydrogen-powered cars due east.t.c.) Therefore, in the long-run, demand may get more cost rubberband.

After the oil price shock of the 1970s, manufacturers also started to change their approach. U.s. machine manufacturers paid more attending to the fuel efficiency of engines. It has also created an incentive to develop alternatives to petrol cars

Also, higher oil prices will encourage firms to endeavour and observe more oil supplies, even if information technology is expensive. Since the oil price stupor of the 1970s, a new wave of countries began producing oil. In countries, such as Venezuela, Russian federation and remote places like the Antarctic.

Effect of higher oil prices in the 2022s

College oil prices in the 2022s, will encourage consumers to expect into ownership electrical cars which don't need oil. In the 2022s, we have more alternatives to oil than we did in the 1970s and 80s.

Also, in the 2022s, college oil prices might not have the same bear on on stimulating investment in discovering new oil fields. Energy companies are wary virtually environmental pressures which make oil less attractive than it used to be. Governments may bring in higher carbon taxes or directly encourage less use of oil. Therefore, high oil prices may not cause the surge in investment that we saw dorsum in the 1980s.

Farther reading

- Do higher oil prices cause recession?

- Factors affecting oil prices

- Adjusting to oil price shocks

- Effect of falling oil prices

What Impact Would A Dramatic Increase In The World Price Of Oil Have On The National Economy,

Source: https://www.economicshelp.org/blog/1919/oil/effect-of-higher-oil-prices/

Posted by: howardribrow.blogspot.com

0 Response to "What Impact Would A Dramatic Increase In The World Price Of Oil Have On The National Economy"

Post a Comment